Writing a trading plan is not difficult or time consuming

(If you approach it the right way)

Writing a trading plan is not difficult or time consuming if you follow the right process. If you don't follow the right process then chances are that you will have a much harder time creating your trading plan.

The 8 steps to writing a trading plan

- Get a good trading plan template

- Sweep through and complete what you can quickly

- Identify and prioritise gaps

- Set timelines to close gaps

- Address knowledge gaps (learn) & populate plan

- Review, scenario test and adjust

- Execute the plan

- Monitor results

1. Get a good trading plan template

Writing a trading plan starting from a blank sheet of paper is slow, difficult and frankly pretty silly. There are many profitable traders who have come before you and thought about what needs to be included in creating a trading plan.

Of course you need to include questions that address your own specific circumstances, but this does not mean you need to do all the thinking yourself. It is much more efficient to use a good trading plan template that gives you all the major components that you need to cover and then add your additional specific considerations in at the end.

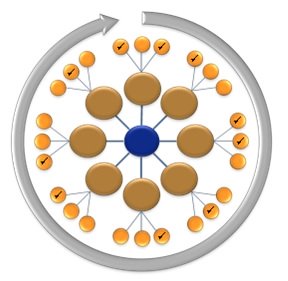

A good trading plan template will cover all 8 components of a complete professional trading plan as illustrated below. These components are explained in more detail in my free trading plan video training which is available by clicking the button below:

2. Sweep through and complete what you can quickly

Once you have your trading plan template, the first step is to sweep through it and complete all the areas you can without further work or research. This gives you an immediate sense of progress and gets you into the right frame of mind. Do this quickly and just skip over any sections for which you do not have an immediate answer.

Try not to labour over your answers initially because this will just slow you down. Writing a trading plan should be done iteratively because otherwise you risk getting bogged down in minor details when there is a massive gaping hole in the next section that you have not completed yet.

The additional benefit of sweeping quickly through the entire trading plan template is that it puts the entire thing into perspective for you. For example there will quite probably be questions in the workbook that you have never considered, so reading through it will give you a whole new perspective and elevate your trading potential just by raising your awareness of these issues to consider.

This really is a case of you don't know what you don't know…so your sweep through the entire trading plan template will make a big difference to the quality of your trading decisions.

3. Identify and prioritise gaps

Now that you have worked through the whole template and completed the areas that you already know, you are ready to identify and prioritise the gaps.

Remember that writing a trading plan is an iterative process, so you may refine or expand your plan in different areas over time. The trick to getting it done is not to get bogged down on any one section.

All gaps in your trading plan are not necessarily of the same importance. For example you would probably want to complete your entry / exit and stop loss rules and your position sizing rules before you worry about some of the detailed activity steps and extreme scenario testing. So when you prioritise, be pragmatic and get the important things done first. Keep sweeping through your gaps and gradually close them all.

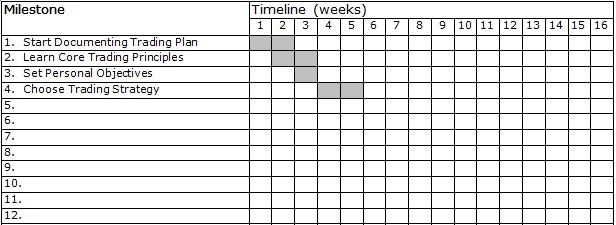

4. Set timelines to close gaps

Some of the gaps you have when you first learn to trade, first develop a trading system and start writing a trading plan will take some education or coaching to close. This is a natural part of learning to trade (or learning any worthwhile skill for that matter).

If you were learning to be a brain surgeon you would expect that it would take some time. You wouldn’t just walk into an operating theatre off the street and expect to cut open someone's skull. The great news is that learning to trade does not take that long, but there is still a learning curve. This means you will need to give yourself some time to learn how to close the gaps in your trading plan.

Allocate time to close your trading plan gaps

Allocate time to close your trading plan gapsNow lots of people will be tempted to skip this and just get started, but your gaps will get closed in one of two ways, whether you like it or not. You will either close them by:

- Learning hard lessons in the markets (a.k.a. losing money); or

- Learning the right skills and developing your plan

I can tell you from experience that the first way (that most people choose) is more expensive, more frustrating and ultimately more time consuming. Do it right - save yourself the time, hassle and expense.

It is far more efficient to identify the gaps you have and find the right education or coaching to close those gaps before you get started with real money. So set yourself a reasonable timeline to close your gaps and avoid the stupid and expensive trading mistakes people make when they just rush in and start trading without a plan.

5. Address knowledge gaps & populate

When you are addressing your knowledge gaps there are many approaches you can use depending on your budget and timeframe. At some point most successful traders will use a combination of trading books, original research, courses / seminars and coaching to address their knowledge gaps.

Take action and seek specifically what you need. There is a lot of information out there, and one of the big mistakes I made when I first learned how to trade was taking the 'scatter gun' approach. I read everything I could and bought a huge number of trading books. This was great for my knowledge, but it was terrible from a time and effectiveness point of view.

This is why I am suggesting that you do the sweep through the entire trading plan template so that you know what you don't know - you identify what it is that you need to learn. This way you can target your learning on your specific gaps and be far more effective that I ever was.

The quickest way to

progress is to get yourself a trading coach. Your coach will give you a

combination of teaching the concepts and working through your specific issues

to help you make progress quickly. Coaching will also make writing a trading plan much faster because you will have someone experienced on call to ask questions and clarify whether you are on the right track. If you are interested in a free consultation

to understand how coaching could work for you, click here.

The great thing about this approach is you will make fast progress and you will waste very little time

Make sure that you continue to populate your trading plan as you learn because this way you will know when you have enough understanding to move onto the next area. The great thing about this approach is you will make fast progress and you will waste very little time.

6. Review, scenario test and adjust

If I have learned anything, it is that my trading plan is a living document - and yours should be too. It is not something that you write once and put away never to be seen again.

I suggest that you critically review your plan and even get an external review done to ensure what you have written is clear and that you have not missed any big gaps. You will be really grateful you have done this when the pressure is on and you are under stress because of what is happening in the market. The clearer you trading plan is, the more effective your actions will be in the markets and the more profitable you will be.

One of my favourite secrets to success is scenario testing of my trading plan. There are just so many things that backtesting a trading system can't show you. For example, have a think about some of the following scenarios and ask yourself whether you have a solid plan to deal with them:

- Your broker goes under and your account is frozen

- One of the stocks you are holding is suspended and then announces bankruptcy

- The entire stockmarket drops suddenly 15-30% overnight

- You get hit by a car and you can't think about your trading for 8 weeks while you recover in

- intensive care in the hospital

- You go on holiday and you unexpectedly have no internet access for 2 weeks

- And many more…

Ensuring that your trading plan covers you and deals with this sort of scenario is one of the biggest secrets to long term success that I can share with you!

7. Execute the plan

When it is time to start trading, the trading plan you have written is the document that you need to follow.

Plan the trade, Trade the plan!

When writing a trading plan, you have put in all your energy and quality thinking in when you are calm and rational, so these are the instructions and steps you should follow in the market.

Just remember, when emotion is high, intelligence is low…this is why we have a trading plan to follow in the first place.

If you find yourself wanting to do something that is not in your trading plan - DON'T.

At least not until you have tested and worked through it out of market hours. Then once you have added to or modified your trading plan then you can take that action, but not before.

8. Monitor results

Part of writing a trading plan is the objectives that you specify for your trading system. The final step in writing a trading plan is to monitor your results against these objectives and how well your followed your plan. If your plan and your trading system are well designed then you should achieve your objectives provided you follow your plan.

When you are monitoring continuously you may become aware of conditions that are outside your normal operating range. This is when you have to determine whether something is wrong and if you have to adjust your trading plan or system (or even stop trading).

Monitoring also extends to yourself. Every time I have to take an action in the market, I observe my emotional response to that action. If I am consistently uncomfortable or if I am not sleeping well or if I am tempted to skip steps, then it is time to reassess my mental state and ensure that I am fit for trading. If I am uncomfortable with my trading plan then it is time for a review and a challenge of the plan!

Conclusion

Just by writing a trading plan and following the 8 steps described above, you will put yourself far ahead of most other traders. Give yourself the best chance of making money and being a successful trader - you certainly deserve it!

If you haven't already got a trading plan yet then I suggest that you register for my free video training on writing a trading plan - click the button below:

Related Articles:

Main Trading Plan Page: Is a trading plan the difference between success and failure?

- Trading Plans - What's the big deal?

- Trade Plan vs Trading Plan - what is the difference and why should I care?

- Writing a trading plan is not difficult or time consuming

- Creating a trading plan the easy way

- Stock trading plan - 5 critical factors

- Small cap trading plan secrets

- Trading Plan & Coaching Information Request

Return to top

Return to Home Page

Looking for something else - Find it on the Sitemap