Learn Stock Trading:

Risk Management and Position Sizing to Avoid Blowup

When you learn stock trading, it is so easy to underestimate the risk you are taking on in each and every trade - I mean after all, you are using stop losses...Seriously though, you are using stop losses aren't you?

The trouble is that sometimes something unexpected happens and stop losses can't save you. Like the time earlier this year when I position I was in dropped 47% overnight and was immediately suspended from trading. I have no idea how much I will lose on the trade...but it doesn't matter because I followed the advice I am giving you in the video below.

In this video I explain why risk management is so important and why you should risk only a very small percentage of your account on each trade. I hope you enjoy it!

There is a transcript at the bottom of the page if you prefer to read instead of watch the video.

Want to Learn Stock Trading Quickly...

If you want to learn stock trading and have someone guide you every step of the way so that you can stay in control and learn how to profit quickly then check out my unique new program by clicking the image on the right.

I would love to help you learn stock trading quickly and address your trading questions for you!

Click the image and enter your email to find out more about this unique new program which allows you to learn stock trading quickly with the support you need.

Video Transcript:

Hi, Adrian Reid here and in this private email coaching program video, I want to talk about the dangers of risking too much on any one stock trade.

This is particularly important when you learn stock trading using system like a long term trend following system that has a large number of small losing trade to a small number of large winners.

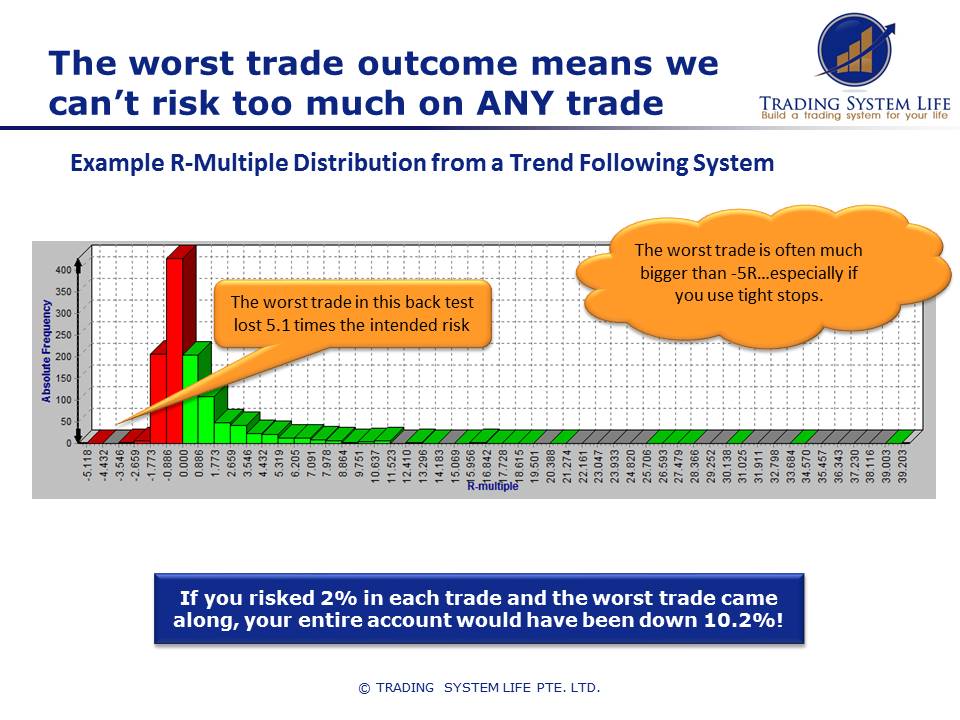

What we got here is the trade distribution profile of a typical trend following system. Details of the system don't matter, but basically in any trend following system that you use, any system that cuts losses short and lets profits run, you're going to get a profile of trades like this.

You'll see on the right hand side a small number of very large winners. This is where the bulk of your profits come from.

Then, you have a larger number of small winners. These are the ones that really help you break even.

Then, you've got a large number of small losses. These are the things that basically chip away at your account. This is where you're really going to manage your risk day to day.

Now, the key thing that you can notice if you look carefully here on the very left hand side is the worst single trade in this entire back test, lost 5.1 times the intended risk.

What this chart represents is the number of trades on the left hand column, and the R-multiple which is the number of time ... the trade return as a function of the amount you intended to risk.

If you intended to risk a thousand dollars, and you won 2,000 dollars, then your R-multiple is 2.

If you intended to risk a thousand dollars, and you lost 1,000 dollars, then the R-multiple would be -1.

This losing trade over here on the very left hand side lost 5.1 times the maximum intended risk. Now, that's 1 trade out of probably thousands on this chart. If that 1 trade existed in the back test, then chances are that 1 trade, or worse, could also exist in the future in your system.

Now, when you're managing your risk for a trading system, this is something you really need to think about because you're going to make sure that your system will survive, and you can profit regardless of what the market throws at you in the future.

The fact that this bad trade, this -5 R-multiple trade existed in the past, means that it could come back and bite you in the future. You need to make sure that the risk per trade that you take on takes into account the worst trade in your back test. Ensuring that your account survives the worst expected trade (and then some) is an important step to take early as you learn stock trading.

Now, just as an example, if you risk 2% on each trade that you took using this system, and that trade came along, this 5R loss, then your entire account would have been down by 10.2% just because of that 1 trade.

Now I don't know about you, but I want to make sure that my account isn't so sensitive or volatile to any 1 trade outcome. A single trade losing 10.2%, especially when I know that trade is there in the back test and therefore potentially might come along again in the future, to me that's an unacceptable risk.

The 2% Position Sizing Rule is Bollocks

(2% is WAY TOO MUCH RISK!)

When you look at your trade distribution profile like this in terms of R-multiples, you need to make sure that you're comfortable with what the amount that you're risking, and what that'll translates to in terms of the worst possible loss.

This is why I teach people that when they you're doing trend following particularly, you need to risk much less than 2% per trade.

Now, I know a lot of authors and educators out there talk about the 2% rule and blah, blah, blah, the reason people talk about risking no more than 2% is not because that's the right amount, it's because if an educator talks to someone and said, "You should risk .2% of your account on each trade," most people will be like, "You're on drugs because how can you possibly make any money risking so little."

The reality is most people actually don't have a clue how to make good consistent profits in the market. Certainly, most people don't understand how to stop themselves from blowing up when the market turns against them. 2% is a very rough, and actually quite aggressive guidance, to stop people from doing really crazy things like risking 5 or 10% of their account on each trade.

The other thing to keep in mind, though, is that while this trading system generated a -5 R-multiple loss, the worst case trade is often far bigger than the -5R that we see here. Now, I've seen trading systems, some that I've tested and played with, where the worst case loss was -10, -20. Now, you don't get very many of those. Again, you've got to be very careful with how your position size, if those sorts of things come along.

What Causes These Big R-Multiple Losses?

What drives the very big R-multiple losses in many cases is a really tight stop loss. If you're using a really tight stop loss, and you get a gap down ,or a gap against your position, then you run the risk of getting these big R-multiple losses.

As my accounts grown, and as I've adjusted my risk profile to be a little more conservative, as I've progressed and really understood the markets, I've started to use slightly wider stop losses and also smaller and smaller position sizing for each trade, because that's enabled me to have the confidence that I'm not going to lose big money when one of those bad trades comes along.

That's all I'm going to talk about in this video. I hope that's been useful and I look forward to seeing your questions and comments in the video stream below.

How Can You Learn Stock Trading Quickly?

If you want to learn stock trading and have someone guide you every step of the way so that you can stay in control and learn how to profit quickly then check out my unique new program by clicking the image below - I would love to help you learn stock trading and address your trading questions for you!

Related Articles:

Main Learn Stock Trading Page: Learn Stock Trading: Get your trading questions answered!

- The stock market is correcting, should I put a stop loss?

- What is curve fitting and why is it a problem?

- Why is too much leverage dangerous?

- When I use end of day data can I trade all time frames with it?

- Is end of day data reliable?

- What is a realistic trading profit target?

- Using Metastock stock market data with Trading Blox

- How much capital should I have at risk in the stock market at any one time?

- What are reasonable CAGR and Drawdown Targets?

- Position sizing the right way

- Risk Management and Position Sizing to Avoid Blowup

Return to top of Risk Management and Position Sizing to Avoid Blowup

Return to Home Page

Looking for something else - Find it on the Sitemap