What is Swing Trading and how does it work?

Swing trading is a strategy that works because markets trend, and within those trends price regularly swings above and below the primary trend. These swings are tradable moves which allow the trader to profit multiple times within the one primary trend.

This works in most asset classes, however it is most profitable where prices trend but also move materially up and down around the primary trend. The intention is to capture quick profits out of the trend by benefiting from these intermediate swings. It is a shorter term trading strategy than trend trading. It is therefore a more active form of trading. It should, however, still be possible to swing trade successfully using end of day data while working full time.

Swing trading can require a high level of activity:

This is a very simple and robust trading strategy. With a good trading system and sound money management it is certainly possible to make very high returns on your account with swing system. As with everything in trading (and life) there are trade-offs to consider.

The primary trade-off for this trading strategy compared to trend trading is that it takes more activity by the trader to generate each dollar of profit. The entry and exits may also require you to look at intraday prices to make your entry / exit decisions depending on your system.

The primary benefit of trading price swings (compared to trend trading) is that trades turnover more quickly, there is generally less profit that you give back at the end of the trade before you close it out. This can be psychologically gratifying, but it doesn’t necessarily mean you will make more money than trend following. Only your trading system development efforts will determine that.

Depending on the trading signals used, swing trading systems may have a higher reliability than trend following systems. This means you get to be right more often, but the average profit per trade will be smaller than with typical trend following systems.

Swing systems can generally be made to be mechanical, however discretionary systems can also be very profitable. For the beginning trader we favour mechanical trading systems because it takes the emotion out of trading and, provided you follow your rules, reduces mistakes caused by emotions and psychological biases.

Components of a swing trading strategy:

Similar to trend trading, these strategies can be applied across multiple markets with minimal, if any modifications. This is because most markets move in a primary trend and also oscillate above and below that trend over time. It is these oscillations above and below the primary trend that a swing trading strategy seeks to capture.

The basic components of the swing trading strategy are:

- A way to identify when a trend is in place

- A low risk entry point at to start of an intermediate move

- An initial stop loss to get you out if you are wrong

- An exit rule that gets you out near the top of the swing move

There are a number of differences between a swing trading strategy and a trend trading strategy because the moves you are trying to capture are different. Each component is explained in the following four paragraphs highlighting the differences that are most relevant.

The definition of a trend being in place will be similar to that used in trend trading, however, you may seek to identify trends with wide ranging swings rather than smooth, stable trends.

The entry point needs to be at the beginning of, or in anticipation of an intermediate term move in the direction of the primary trend. This means after a correction has slowed or the move in the direction of the primary trend has just commenced. It is important not to wait for too much confirmation here because the swing move is relatively small and so a timely entry will help ensure your system captures sufficient profits.

The initial stop loss is often tighter than in long term trend following because it is important to keep losses small relative to the size of average gains. Average gains are smaller than long term trend following because you are only seeking to profit from intermediate term moves rather than the entire primary trend. This means you will need a tighter stop compared to a trend trading strategy.

The exit rules are extremely important to maintain profitability. In swing trading you do not have the luxury of letting your profits run for an extended period as you would with a wide trailing stop in a trend trading strategy. Instead the strategy seeks to exit at or near the top of the swing move. This can be done by using some combination of a profit target, exiting based on projected price levels, a time based exit or a tighter trailing stop.

If your trading strategy has all of these components, combined with good risk management rules, then you have a good chance of being able to develop a profitable trading system. (Of course you will need to undertake the correct trading system development for yourself to be sure as there are no guarantees your rules will be profitable).

Which markets do swing trading systems work for?

It is possible to trade price swings effectively in the stock market, futures and commodity markets and in forex / currency trading. The differences between these markets are less significant than for trend trading because the duration of trades is shorter, however many of the same issues apply as are discussed here.

The following charts illustrate the type of moves you may seek to capture.

Stock Swing Trading:

The chart of ANZ bank below illustrates the primary up trend from late 2011 to mid 2013. Within this trend there were three major swing moves which could have been extremely profitable with the right trading system.

Stock Price Swing Example: ANZ Bank (ANZ:ASX)

These intermediate term price swings lasted several months each. It is not necessary to always look for swings of this magnitude. Shorter term systems are possible; however, the average profits will be smaller as you reduce the trade duration.

In our trading systems section you will see that these price swings can be identified and exploited using simple mechanical trading systems which look only at price data – it is not necessary to do hundreds of hours of fundamental research to identify a stock that has tradeable price swings above and below the primary trend and profit from it.

Futures Swing Trading:

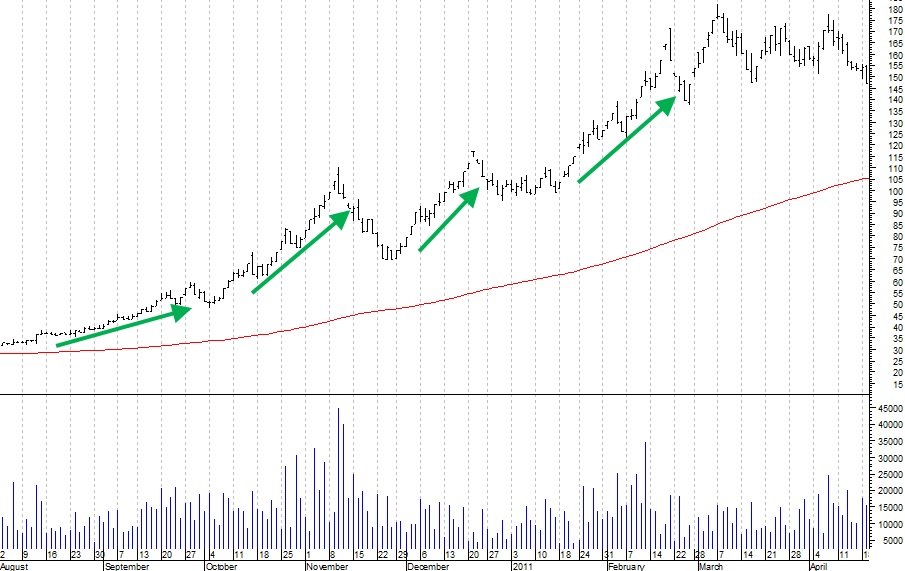

Futures price trends are frequently punctuated with sharp retracements as illustrated in the Cotton chart below.

The extremely patient trader may apply a trend trading strategy which benefits from the entire primary trend, while the nimble swing trader may move in and out of a trend like this several times as illustrated by the arrows on the chart.

Both strategies can be profitable, however the duration and average profit per trade are both significantly shorter for the strategy that trades price swings.

Futures Price Swing Example: Cotton

The benefit of the shorter term moves in the swing trading strategy is that you can keep your capital tied up for a shorter period before moving on to the next trade.

If you have a profitable swing system this may allow you to compound your returns more efficiently than a longer term system provided the average profit per trade is high enough and transaction costs don’t hurt performance too much. This is particularly powerful in the futures markets which give good diversification - magnifying the impact of the faster compounding.

Forex Swing Trading:

Similar to futures, many primary forex trends are punctuated with sharp retracements as illustrated in the USDGBP chart below. The chart below shows at least 5 swing moves that could have been captured during the down trend of the USDGBP currency pair during 2006-2007.

Forex Price Swing Example: USDGBP

If you have difficulty holding onto trades for the entire duration of the primary trend and prefer to bank smaller profits regularly you can see how trading this type of move may appeal.

Can a swing trading strategy fit in with a day job?

YES! This is a form of trading that can be learned and can fit in easily with whatever else you have in your life at the moment provided you select your trading timeframe to allow this. Trading off daily price bars will work with a day job, but using hourly or 4 hourly price bars for your swing trading system will make trading with a day job difficult.

Swing systems require very little time each day (or week)

to execute and can be run while you still have a full time job.

Once you understand the concepts and codify them into a mechanical trading system it becomes a matter of simply running your system scans each day and executing to the rules.

Your trading strategy can be designed to eliminate any form of judgment, so assuming everything is documented properly in your trading plan the decisions are very quick to make on a day to day basis.

What swing trading software do you need?

To develop a profitable swing trading system, you will need a charting package, daily market data covering the markets you intend to trade and trading software capable of backtesting and optimizing your trading system.

If you are planning to trade shorter term swings than those illustrated above you may need to use an hourly chart to time your entries and exits effectively. However, we suggest that in the first instance new traders stick with the daily bar chart because trading on daily bars gives the best lifestyle flexibility, reduces the need to look at the computer screen during the day and keeps your costs low (intraday data is more expensive than end of day data).

If you are just getting started you do not have these packages, we recommend you look at the following:

- Metastock to display your charts and think through your trading strategy visually

- Reuters Data (purchased in a package with Metastock covering all required markets) and

- Tradesim by Compuvision to backtest your strategy

This combination will allow you to cost effectively get started and develop your own trading system (this will also cover trend trading and mean reversion, chart pattern trading and various other end of day trading systems).

If you are a more advanced trader or intend to backtest and trade multiple systems in a portfolio then consider purchasing TradingBlox. TradingBlox is a more expensive solution, but allows far more sophistication in the backtesting and optimization of your trading strategies. TradingBlox is the portfolio simulation tool of choice!

Related Articles:

- Main Trading Strategy Page: Does your stock trading strategy REALLY suit you?

- Best Trading Strategy – Self Assessment Questionnaire

- Trend Trading / Trend following - What is it and how does it work?

- Trend Following Stocks is a great trading strategy

- Swing Trading - What is it and how does it work?

- Mean reversion to diversify your trading program

Return to top of Swing Trading.

Return to Home Page

Looking for something else - Find it on the Sitemap