Penny Stock Trading Systems - Benefits and Pitfalls

Penny stock trading systems promise massive gains due to the big moves that can occur in penny stocks. But as always, all that glitters is not gold and you must understand 5 specific considerations before building a Penny Stock System or subscribing to a newsletter.

The world of penny stock trading is cluttered with pump and dump scams, dodgy newsletter promoters, overpriced and extremely misleading claims. There are many websites offering overnight riches and million dollar returns starting with nothing by taking just a few penny stock trades from their monthly subscription newsletter. As we explain below, these promoters often use extremely misleading claims that you can’t (or shouldn’t) try to replicate with your own money.

The Trading System Life! philosophy is to profit consistently and confidently using a proven trading system designed by you, so that it fits you and supports the life you want. Penny stock trading systems could certainly play an important part in the delivery of this philosophy if you understand the pitfalls and capture the benefits of trading penny stocks.

What are Penny Stocks?

According to the SEC:

“The term "penny stock" generally refers to a security issued by a very small company that trades at less than $5 per share. Penny stocks generally are quoted over-the-counter, such as on the OTC Bulletin Board (which is a facility of FINRA) or OTC Link LLC (which is owned by OTC Markets Group, Inc., formerly known as Pink OTC Markets Inc.); penny stocks may, however, also trade on securities exchanges, including foreign securities exchanges. In addition, the definition of penny stock can include the securities of certain private companies with no active trading market.”

All Trading System Life! discussions about different trading strategies and trading systems focus on financial instruments that trade on securities exchanges such as the ASX, Nasdaq or the NYSE. This is because the level of access, price data and transparency is much better with small capitalization stocks that are traded on a major exchange. Thus for the purposes of this discussion I will define Penny Stocks as very low priced shares in small cap or micro cap companies which are traded on an exchange.

The price cutoff for penny stocks is fairly arbitrary as far as penny stock trading systems are concerned. The appropriate level varies depending on which exchange they are listed on. For example, a $5 share on the NYSE would be considered to be a Penny Stock, but on the ASX many large companies have share prices as low as $5 because of the high tendency for stock splits to keep price per share low in this market.

For my penny stock trading systems I focus exclusively on publically listed companies that are traded on a major exchange. I also only trade in fully paid ordinary shares because you may be in for a nasty surprise if you trade certain types of shares that come with future payment obligations.

Why are Penny Stock Trading Systems so Appealing?

In my view, penny stock trading systems are appealing for three primary reasons:

- Potential for large company growth

- Price leverage due to low price per share and low market capitalization

- Diversification

The appeal of penny stock trading systems is simple – small companies can and sometimes do experience massive growth. If you catch a move in the right penny stock at the right time, just as the company is taking off you could make thousands of percent profit or more on a single trade. Just like the example below, penny stock trading systems have the potential to capture these large profitable moves.

In addition to the large growth that penny stocks sometimes experience, they offer a different form of leverage than your margin loan – they offer price leverage. The low price per share and small market capitalization mean that once a penny stock captures the attention of the market and volume moves into it the share price can be pushed up very quickly. This form of leverage has a different risk profile than trading on margin and so can be appealing.

The final source of appeal is diversification. Penny stock trading systems can provide some diversification from a standard long side stock trading system because the drivers of share price in a particular penny stock will likely be more company specific than broad based market moves.

For example a new product launch, entry into a new market, or new discovery could spark massive growth in earnings for a small company but for a large company this may not even register as news. Thus moves in penny stocks may not always be correlated to moves in other stocks (although the broader market will obviously impact penny stocks and few companies escape a bear market without being impacted).

Warning – Scam and Misleading Newsletter Promoters

If you have searched for penny stock trading systems online then chances are you will have come across a website or newsletter service claiming something like “learn how to turn $500 into $5.73m and retire forever in just five trades!”

Now penny stock trading systems have huge profit potential but really – have you ever heard anything more ridiculous than claims like this? Typically what these penny stock trading services do is generate a large number of trade signals that subscribers pay a hefty monthly fee for. Every now and then (as happens in penny stocks) they might come across a couple of large hypothetical winners in a row.

When this happens, they figure out the percentage profit for each trade (say they were 123%, 412%, 325% and 386%) and then determine what the theoretical compound return would be if you gambled 100% of your account on each of those trades. Let’s say you have a $5000 account and you bet it all on each of these four trades in succession:

- After the first trade you would have $11,150 ($5000 initial stake + $5000 x 123% profit)

- After the second trade you would have $57,088

- After the third trade you would have $242,624

- After the forth trade you would have $1,179,153

See you could have become a millionaire starting with $5000 in just four trades! (Insert sarcasm here)

There are so many flaws with this it is hard to know where to start…but here are a few to help you come back down to earth after reading some of the ridiculous claims that are out there:

- You never ever put your entire account (or even a large percentage of it) into one trade because the chance of losing it all is just too high. You would have to be very brave (stupid) to take your entire $57,088 after the second trade and put it all into another penny stock recommendation…let alone $242K or $1.179M! If the next trade was a pump and dump or went out of business you would have lost it all.

- The hypothetical examples never incorporate the effects of slippage. Because penny stocks are so illiquid, it is very difficult to get in and out without moving the share price. You need to be careful with a $5K position, so the chance of getting a good price with a $57K or $242K position is basically zero. Much of your profit can be eaten up with slippage costs and the newsletter promoters never seem to take this into account.

- These examples are always based on a well-chosen sequence of trades – “if you took these four trades that we recommended then you could have been a millionaire too” but what about all the other trades they recommended that tanked or went nowhere? If you invested your entire account in just one of those you would be sorry!

The good news is:

Even though the penny stock world is full of scams and fraudsters,

you can still design profitable penny stock trading systems!

I again come back to the Trading System Life! philosophy of using a proven trading system designed by you, so that it fits you. If you know how to properly perform trading system development then you can build a profitable penny stock trading system.

5 Considerations for REAL Penny Stock Trading Systems

In this section I will explain the five considerations that you must take into account if you are to design your own profitable penny stock systems. These are:

- Liquidity

- Volatility

- Slippage

- Lack of reliable information

- Pump and dump scams

1. Liquidity and Penny Stock Trading Systems

Penny stocks are small companies with little to no analyst coverage or institutional investment. While this means large moves are possible, it also means that not many shares are traded each day.

Low liquidity means penny stock trading systems must be designed to maintain small position sizes relative to the average daily traded volume for the penny stocks the system trades. If position sizes are too large then it will be impossible to fill the positions without moving the market.

A rule such as positions must be less than 10% of the average traded volume of the stock help reduce the impact of the low liquidity found in penny stocks.

2. Volatility and Penny Stock Trading Systems

Many penny stocks are so volatile and so illiquid that the stock price seems to jump around all over the place from day to day, and may not even trade at all on some days.

Stocks with low volatility generate better returns

for medium to long term trading systems

Now I know this goes against the generally accepted idea that volatile stocks give you the best gains, but objective backtesting on a portfolio level does not lie! Test it out for yourself.

Highly volatile stocks are more risky, have a greater probability of blowing through your stops and generating big losses and don’t move as smoothly as low volatility stocks. With low volatility stocks you can take larger positions and make higher returns per dollar risked.

The lesson is the same for penny stock systems:

Trade penny stocks with lower volatility – you get better

trading signals and higher returns per dollar risked

I filter out stocks from all my systems that don’t trade on essentially every trading day in the market. If the stock does not have enough interest to trade every day then it is going to be difficult to make money with it in your penny stock trading systems.

3. Slippage and penny stock trading systems

Slippage refers to difference between the expected price of a trade and the price the trade is actually executed at. In penny stocks (or stocks in general), slippage can be high when there is a wide bid-ask spread as is often the case with penny stocks. Slippage can also increase when the order is large relative to the volume available at the bid or the ask.

When designing a penny stock trading system the cost of slippage is an important consideration because as your account grows this will become more and more severe unless you are careful to control it.

Here are 6 ways to control slippage in penny stock trading systems:

- Increase your time horizon: longer timeframes trade less frequently and suffer the impact of slippage less often

- Use limit orders: rather than placing ‘at market’ orders which suffer more slippage, consider using limit orders. You may miss some trades, but your slippage costs will be dramatically lower

- Pyramid your positions: taking several small positions over time in a penny stock rather than a single large position may also help you reduce the impact of slippage. This is because small positions suffer less slippage than large positions. Build you trading system to have multiple trading signals that get you in over a period of time to reduce your entry slippage.

- Staged exits: Just like pyramiding can reduce slippage on the way in, having multiple exit points which give you exit signals on different days can reduce the slippage you incur on exits. Build your trading system to have multiple trading signals that get you out over a period of time to reduce your exit slippage.

- Small position size: using a low level of risk per trade and capping your positions at a small percentage of daily volume (say 10%) will reduce the impact of slippage.

- Wide initial stops: Wider initial stops will mean that slippage becomes a smaller percentage of your risk per trade. This reduces the difference between hypothetical simulations and actual trading results. It also results in stops being hit less often so reduces the number of trades and the impact of slippage.

4. Lack of reliable information and penny stock trading systems

Small companies and penny stocks in particular have low news flow and little publically available information to perform accurate stock price valuations. This means that your penny stock trading system will probably need to be 100% technical in nature rather than based on company fundamentals or news announcements.

This is the way I develop all my trading systems because I don’t want to spend time researching company fundamentals – I want to have more Life!

Technical trading systems give more time to enjoy your life because they don't take much time to run each day

5. Pump and dump scams and penny stock trading systems

A pump and dump scheme (scam) is where promoters of a stock greatly inflate claims about a stock to encourage investors to buy it and push up the price. Once the price is artificially inflated they sell their own shares at a profit and the stock price drops rapidly.

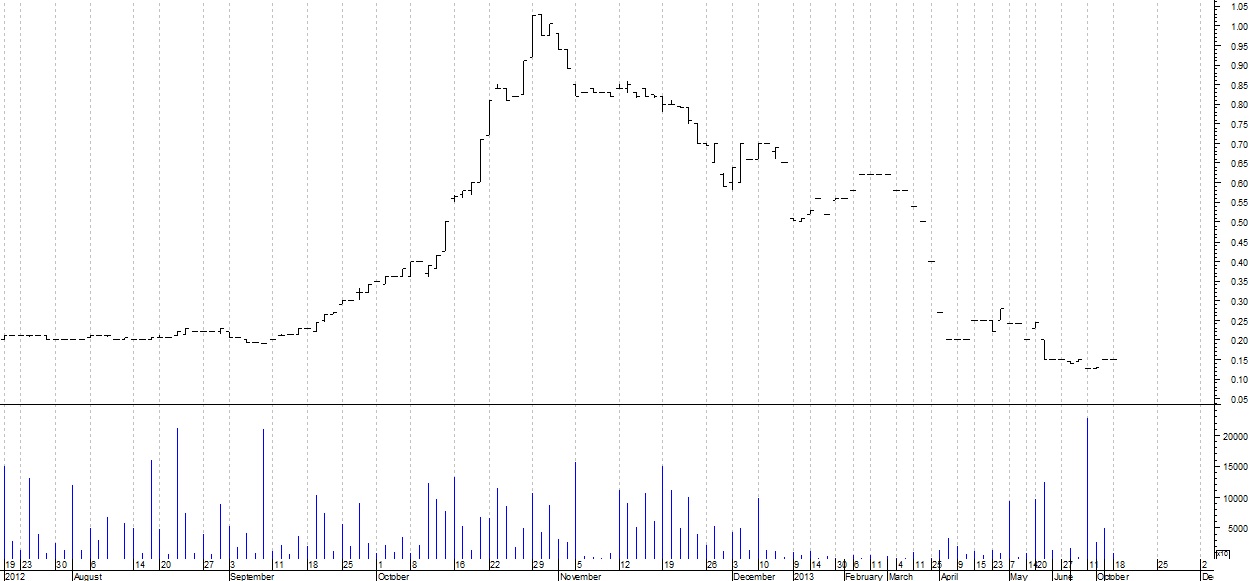

The chart of a pump and dump scheme in hindsight will look something like this. Penny stock trading systems need to avoid these profiles as much as possible.

Penny stocks can be particularly susceptible to pump and dump scams and so your penny stock trading system must be designed to mitigate this risk. You can mitigate your risk of getting caught in a pump and dump with the following measures:

- Increasing investor interest: Penny stocks with steadily increasing volume over a period of time, combined with steadily rising price are more likely to be driven by fundamental factors than stocks which have had a sudden spike in price and volume with no apparent reason.

- Stable up trend: Penny stocks with a steady up trend over a period of time are more likely to be legitimately growing rather than part of a pump and dump scam.

- Pyramid: Building positions gradually over time provided the trend continues can be a good way of ensuring you don’t get caught up in a pump and dump. Your first trade may be exposed, but if the trend continues nicely over time then your subsequent positions are unlikely to be impacted because the trend is more likely to be legitimate.

Conclusion

Penny stock trading systems have real potential to build your wealth and freedom, however, as always there are scams and misinformation around to trap the uninformed.

Trading System Life! advocates building your own trading

systems as this reduces these risks and puts you in control

When building your penny stock trading system you should take measures to reduce the impact of penny stock challenges such as low liquidity, high volatility, slippage, lack of reliable information and ‘Pump and dump’ scams.

The good news is that it is possible to build a profitable penny stock system. If you would like an example of a profitable penny stock trading system I will shortly document one here along with the beliefs and trading rules associated with the system. Come back soon and check it out!

Related Articles:

Main Page: What are stock trading systems and how do they work?

- Trading System Development - The Right Way

- Mechanical trading systems save you from yourself!

- What makes a good trading system?

- Choosing the best trading system

- Trend Following System Components

- Penny Stock Trading Systems - Benefits and Pitfalls

- Trading Signal Beliefs - Example System

- Should I consider paper trading before using real money?

Return to top of Penny Stock Trading Systems

Return to Home Page

Looking for something else - Find it on the Sitemap